加州圣何塞,2022年8月12日 – 激光雷达公司Velodyne Lidar(NASDAQ: VLDR, VLDRW)公布了截至2022年6月30日第二季度的财务报告。

Velodyne Lidar首席执行官Ted Tewksbury博士表示:“今年第二季度,我们在工业与机器人、智能基础设施及自动驾驶这三大目标市场均看到强劲的客户需求。凭借Velodyne运营团队的出色执行力,我们在面临供应链持续紧张的冲击下,成功实现了连续收入增长。”

Tewksbury博士提到:“我们始终专注于为客户提供智能视觉解决方案,致力于将激光雷达扩展为可盈利的增长型业务,并为股东带来投资回报。随着公司增长战略的确立,我们在有序推进的过程中采用多项举措,以达到提升毛利率和降低成本的目标。为保证公司的收支结构与未来4-6个季度的收入预期保持一致,这些措施是必要的。与此同时,我们也在选择性投资相应的战略产品,为实现长期增长目标保驾护航。”

Tewksbury博士说:“第三季度,我们将迎来强劲的业务需求。然而,供应链紧张依然是我们面临的挑战。由于这些持续存在的外部因素,我们预计第三季度的交付账单金额将保持在1000万至1200万美元,收入为800万至1100万美元。其中差额来源于亚马逊认股权证相关的100万至200万美元非现金对冲收入。”

The second quarter of 2022 includes the accounting for the warrants associated with the Amazon agreement that was announced on February 4, 2022. The primary impact for the accounting of the Amazon warrants is that reported revenues will diverge from cash flow.

As a result, Velodyne is expanding the financial information it will report to provide more perspective on the company’s underlying business performance by including a billings metric. Billings represents the dollar value of products and services provided during the current period and invoiced to the customer. Management uses this metric to track commercial growth, establish performance targets, and make budgeting and operating decisions. Billings does not include the effect of the contra revenue associated with the Amazon warrants.

In addition to our results determined in accordance with generally accepted accounting principles in the United States (GAAP), we believe the non‑GAAP measures of non-GAAP gross profit (loss), non-GAAP gross margin, non-GAAP operating expenses, non‑GAAP operating loss, non-GAAP net loss, and non‑GAAP net loss per share are useful in evaluating our operating performance. Certain of these non-GAAP measures exclude a discontinued product line, stock-based compensation and related employer payroll taxes, litigation settlements and amortization of acquisition-related intangibles assets. We believe that non‑GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance and assists in comparisons with other companies, some of which use similar non‑GAAP information to supplement their GAAP results. The non‑GAAP financial information is presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly‑titled non‑GAAP measures used by other companies. Reconciliation tables of the most comparable GAAP financial measures to the non-GAAP financial measures are used in this press release.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our financial outlook and market positioning. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”, “believe”, “may”, “will”, “should”, “can have”, “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including: the impact on our operations and financial condition from the effects of the current COVID-19 pandemic both on Velodyne’s business and those of its customers and suppliers; supply chain issues in the semiconductor market; Velodyne’s ability to execute its business plan; the timing of revenue from existing customers, including uncertainties related to the ability of Velodyne’s customers to commercialize their products and the ultimate market acceptance of these products; uncertainties related to Velodyne Lidar’s estimates of the size of the markets for its products and future revenue opportunities, including projects that are not yet signed or awarded; charges related to the vesting of the Amazon Warrant; the rate and degree of market acceptance of Velodyne Lidar’s products in a variety of industries; the success of other competing lidar and sensor-related products and services that exist or may become available; rising costs adversely affecting Velodyne’s profitability; uncertainties related to Velodyne Lidar’s current litigation and potential litigation involving Velodyne Lidar or the validity or enforceability of Velodyne Lidar’s intellectual property; Velodyne Lidar’s ability to partner with and rely on third party manufacturers; general economic and market conditions impacting demand for Velodyne Lidar’s products and services; and changes in applicable laws or regulations.

Given these factors, as well as other variables that may affect Velodyne Lidar’s operating results, you should not rely on forward-looking statements, assume that past financial performance will be a reliable indicator of future performance, or use historical trends to anticipate results or trends in future periods. The forward-looking statements included in this press release relate only to events as of the date hereof. Velodyne Lidar undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

关于Velodyne Lidar, Inc.

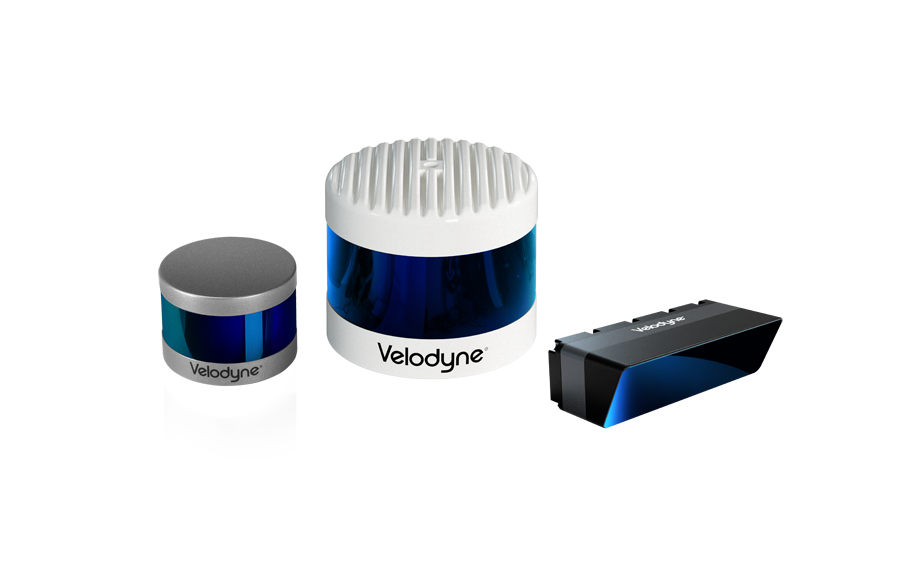

Velodyne Lidar(Nasdaq: VLDR, VLDRW)通过实时环绕视图激光雷达传感器的发明,开创了自动驾驶技术的新纪元。Velodyne是激光雷达的全球领先企业,并以其突破性的激光雷达技术的广泛组合而享有盛誉。Velodyne革命性的传感器和软件解决方案提供灵活性、高质量和可靠性能,可满足各行各业的需求,包括机器人、工业、智能基础设施、自动驾驶汽车及高级驾驶辅助系统(ADAS)。通过不断创新,Velodyne致力于通过促进所有人的安全出行来改变生活和社区。 欲了解更多详情,敬请访问www.velodynelidar.com.

媒体联络:

万卓睿桥公关

周冉 / Joyce Zhou

电话:+86 186-1293-837

周晓雅 / Stephanie Zhou

电话:+86 150-0108-9665

VELODYNE LIDAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| June 30, | December 31, | ||

| 2022 | 2021 | ||

| Assets | |||

| Current assets: | |||

| Cash and cash equivalents | $ 77,024 | $ 24,064 | |

| Short-term investments | 152,185 | 270,357 | |

| Accounts receivable, net | 7,085 | 8,881 | |

| Inventories, net | 13,467 | 9,299 | |

| Prepaid and other current assets | 9,545 | 14,822 | |

| Total current assets | 259,306 | 327,423 | |

| Property, plant and equipment, net | 13,603 | 14,710 | |

| Operating lease right-of-use (ROU) assets | 16,557 | 16,891 | |

| Goodwill | 1,189 | 1,189 | |

| Intangible assets, net | 448 | 724 | |

| Contract assets | 9,182 | 12,962 | |

| Other assets | 1,557 | 1,522 | |

| Total assets | $ 301,842 | $ 375,421 | |

| Liabilities and Stockholders’ Equity | |||

| Current liabilities: | |||

| Accounts payable | $ 8,445 | $ 5,105 | |

| Accrued expense and other current liabilities | 28,133 | 33,028 | |

| Operating lease liabilities, current | 2,896 | 2,623 | |

| Contract liabilities, current | 5,347 | 6,348 | |

| Total current liabilities | 44,821 | 47,104 | |

| Operating lease liabilities, non-current | 14,646 | 15,210 | |

| Contract liabilities, non-current | 10,740 | 12,740 | |

| Long-term tax liabilities | 449 | 443 | |

| Other long-term liabilities | 988 | 661 | |

| Total liabilities | 71,644 | 76,158 | |

| Commitments and contingencies | |||

| Stockholders’ equity: | |||

| Preferred stock | — | — | |

| Common stock | 22 | 20 | |

| Additional paid-in capital | 851,132 | 825,988 | |

| Accumulated other comprehensive loss | (1,203) | (412) | |

| Accumulated deficit | (619,753) | (526,333) | |

| Total stockholders’ equity | 230,198 | 299,263 | |

| Total liabilities and stockholders’ equity | $ 301,842 | $ 375,421 |

VELODYNE LIDAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

| Three Months Ended | Six Months Ended | ||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | June 30, 2022 | June 30, 2021 | |||||

| Revenue: | |||||||||

| Product | $ 9,652 | $ 4,362 | $ 11,970 | $ 14,014 | $ 22,563 | ||||

| License and services | 1,855 | 1,818 | 1,626 | 3,673 | 8,759 | ||||

| Total revenue | 11,507 | 6,180 | 13,596 | 17,687 | 31,322 | ||||

| Cost of revenue: | |||||||||

| Product | 18,347 | 15,196 | 19,210 | 33,543 | 34,839 | ||||

| License and services | 257 | 267 | 170 | 524 | 349 | ||||

| Total cost of revenue | 18,604 | 15,463 | 19,380 | 34,067 | 35,188 | ||||

| Gross loss | (7,097) | (9,283) | (5,784) | (16,380) | (3,866) | ||||

| Operating expenses: | |||||||||

| Research and development | 18,757 | 21,297 | 17,009 | 40,054 | 35,387 | ||||

| Sales and marketing | 5,340 | 6,005 | 47,176 | 11,345 | 54,251 | ||||

| General and administrative | 13,430 | 12,317 | 19,133 | 25,747 | 36,169 | ||||

| Total operating expenses | 37,527 | 39,619 | 83,318 | 77,146 | 125,807 | ||||

| Operating loss | (44,624) | (48,902) | (89,102) | (93,526) | (129,673) | ||||

| Interest income | 294 | 227 | 109 | 521 | 212 | ||||

| Interest expense | — | (3) | (41) | (3) | (77) | ||||

| Other income (expense), net | (110) | 4 | 10,136 | (106) | 10,119 | ||||

| Loss before income taxes | (44,440) | (48,674) | (78,898) | (93,114) | (119,419) | ||||

| Provision for (benefit from) income taxes | (141) | 447 | 339 | 306 | 635 | ||||

| Net loss | $ (44,299) | $ (49,121) | $ (79,237) | $ (93,420) | $ (120,054) | ||||

| Net loss per share: | |||||||||

| Basic and diluted | $ (0.22) | $ (0.25) | $ (0.41) | $ (0.47) | $ (0.63) | ||||

| Weighted-average shares used in computing net loss per share: | |||||||||

| Basic and diluted | 198,947,058 | 198,166,060 | 193,002,807 | 198,414,502 | 191,123,251 | ||||

VELODYNE LIDAR, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except share and per share data)

(Unaudited)

| Three Months Ended | Six Months Ended | ||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | June 30, 2022 | June 30, 2021 | |||||

| Gross loss on GAAP basis | $ (7,097) | $ (9,283) | $ (5,784) | $ (16,380) | $ (3,866) | ||||

| Gross margin on GAAP basis | (62) % | (150) % | (43) % | (93) % | (12) % | ||||

| Discontinued product line | 2,151 | — | — | 2,151 | — | ||||

| Stock-based compensation and related employer payroll taxes | 767 | 528 | 451 | 1,295 | 1,262 | ||||

| Gross loss on non-GAAP basis | $ (4,179) | $ (8,755) | $ (5,333) | $ (12,934) | $ (2,604) | ||||

| Gross margin on non-GAAP basis | (36) % | (142) % | (39) % | (73) % | (8) % | ||||

| Operating expenses on GAAP basis | $ 37,527 | $ 39,619 | $ 83,318 | $ 77,146 | $ 125,807 | ||||

| Stock-based compensation and related employer payroll taxes | (5,600) | (4,474) | (53,624) | (10,074) | (66,969) | ||||

| Legal settlements | — | — | (2,245) | — | (1,245) | ||||

| Amortization of acquisition-related intangible assets | (96) | (96) | (97) | (192) | (193) | ||||

| Operating expenses on non-GAAP basis | $ 31,831 | $ 35,049 | $ 27,352 | $ 66,880 | $ 57,400 | ||||

| Operating loss on GAAP basis | $ (44,624) | $ (48,902) | $ (89,102) | $ (93,526) | $ (129,673) | ||||

| Discontinued product line | 2,151 | — | — | 2,151 | — | ||||

| Stock-based compensation and related employer payroll taxes | 6,367 | 5,002 | 54,075 | 11,369 | 68,231 | ||||

| Legal settlements | — | — | 795 | — | 1,245 | ||||

| Amortization of acquisition-related intangible assets | 96 | 96 | 97 | 192 | 193 | ||||

| Operating loss on non-GAAP basis | $ (36,010) | $ (43,804) | $ (34,135) | $ (79,814) | $ (60,004) | ||||

| Other income (expense), net on GAAP basis | $ (110) | $ 4 | $ 10,136 | $ (106) | $ 10,119 | ||||

| Gain from forgiveness of PPP loan | — | — | (10,124) | — | (10,124) | ||||

| Other income (expense), net on non-GAAP basis | $ (110) | $ 4 | $ 12 | $ (106) | $ (5) | ||||

| Net loss on GAAP basis | $ (44,299) | $ (49,121) | $ (79,237) | $ (93,420) | $ (120,054) | ||||

| Discontinued product line | 2,151 | — | — | 2,151 | — | ||||

| Stock-based compensation and related employer payroll taxes | 6,367 | 5,002 | 54,075 | 11,369 | 68,231 | ||||

| Legal settlements | — | — | 795 | — | 1,245 | ||||

| Amortization of acquisition-related intangible assets | 96 | 96 | 97 | 192 | 193 | ||||

| Gain from forgiveness of PPP loan | — | — | (10,124) | — | (10,124) | ||||

| Net loss on non-GAAP basis | $ (35,685) | $ (44,023) | $ (34,394) | $ (79,708) | $ (60,509) | ||||

| Net loss per share on GAAP basis | |||||||||

| Basic and diluted | $ (0.22) | $ (0.25) | $ (0.41) | $ (0.47) | $ (0.63) | ||||

| Weighted-average shares on GAAP basis | |||||||||

| Basic and diluted | 198,947,058 | 198,166,060 | 193,002,807 | 198,414,502 | 191,123,251 | ||||

| Net loss per share on non-GAAP basis | |||||||||

| Basic and diluted | $ (0.18) | $ (0.22) | $ (0.18) | $ (0.40) | $ (0.32) | ||||

| Weighted-average shares on non-GAAP basis | |||||||||

| Basic and diluted | 198,947,058 | 198,166,060 | 193,002,807 | 198,414,502 | 191,123,251 | ||||

Velodyne Lidar (Nasdaq: VLDR, VLDRW) ushered in a new era of autonomous technology with the invention of real-time surround view lidar sensors. Velodyne, a global leader in lidar, is known for its broad portfolio of breakthrough lidar technologies. Velodyne’s revolutionary sensor and software solutions provide flexibility, quality and performance to meet the needs of a wide range of industries, including robotics, industrial, intelligent infrastructure, autonomous vehicles and advanced driver assistance systems (ADAS). Through continuous innovation, Velodyne strives to transform lives and communities by advancing safer mobility for all.