SAN JOSE – February 28, 2022 – Velodyne Lidar, Inc. (NASDAQ: VLDR, VLDRW), the leading lidar company known worldwide for its broad portfolio of breakthrough lidar technologies, today announced financial results for its fourth quarter and year ended December 31, 2021.

“Lidar is going to transform virtually every industry as we know it, creating a safer, more efficient, and sustainable world. Velodyne Lidar is well positioned to capitalize on this opportunity,” said Dr. Ted Tewksbury, CEO of Velodyne Lidar. “We expect the first wave of lidar commercialization to be dominated by industrial automation, robotics, and intelligent infrastructure. These industries are estimated to reach a $2.8 billion total available market by 2026, according to YOLE. By supplying high-performance lidar at scale into these early autonomous markets, Velodyne expects to expand our technologies and further our leadership in low-cost, high-quality, volume manufacturing. This will enhance our advantage in the second wave of lidar growth – autonomous vehicles and advanced driver-assistance systems (ADAS) – bringing our total available market estimate to $5.7 billion by 2026, according to YOLE.

“During the fourth quarter of 2021, we achieved record quarterly sensor shipments, bringing our lifetime shipments to more than 67,000. In 2022, we plan to focus on four strategic pillars to make lidar ubiquitous and accelerate our path to profitable revenue growth:

“Velodyne has the right technologies and the proven ability to produce high performance lidar at scale. In 2022 and beyond, we will build on this foundation with a game-changing portfolio of AI-powered, autonomous vision solutions while driving revenue growth and profitability with our existing products. We are excited to lead the way as lidar revolutionizes our lives and makes our communities safer,” concluded Tewksbury.

A reconciliation between historical GAAP and non-GAAP information is provided in the tables below.

Due to an increasingly dynamic supply and demand environment, management is shifting to a quarterly guidance practice in 2022.

Revenue is expected to range between $10 million and $12 million for first quarter 2022, driven by shipments of product to the company’s global customer base. Guidance excludes an estimate of the non-cash contra revenue charges of $5.0 million to $7.5 million vesting in the first quarter of 2022 expected to result from the issuance to Amazon.com NV Investment Holdings LLC of a warrant (the “Amazon Warrant”) to purchase up to an aggregate of 39,594,032 shares of the company’s common stock, subject to adjustment and vesting in accordance with the terms and conditions set forth in the Amazon Warrant.

Velodyne will host a conference call and live webcast for analysts and investors at 4:30 p.m. Eastern Time on February 28, 2022. Parties in the United States and Canada can access the call by dialing 877-270-2148. The webcast will be accessible on Velodyne’s investor relations website at https://investors.velodynelidar.com. A telephonic replay of the conference call will be available through March 7, 2022. To access the replay, parties in the United States and Canada should call 877-344-7529 and enter conference code 5202757.

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our financial outlook and market positioning. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”, “believe”, “may”, “will”, “should”, “can have”, “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including: the impact on our operations and financial condition from the effects of the current COVID-19 pandemic both on Velodyne’s business and those of its customers and suppliers; supply chain issues in the semiconductor market; Velodyne’s ability to execute its business plan; the timing of revenue from existing customers, including uncertainties related to the ability of Velodyne’s customers to commercialize their products and the ultimate market acceptance of these products; uncertainties related to Velodyne Lidar’s estimates of the size of the markets for its products and future revenue opportunities, including projects that are not yet signed or awarded; charges related to the vesting of the Amazon Warrant; the rate and degree of market acceptance of Velodyne Lidar’s products in a variety of industries; the success of other competing lidar and sensor-related products and services that exist or may become available; rising costs adversely affecting Velodyne’s profitability; uncertainties related to Velodyne Lidar’s current litigation and potential litigation involving Velodyne Lidar or the validity or enforceability of Velodyne Lidar’s intellectual property; Velodyne Lidar’s ability to partner with and rely on third party manufacturers; general economic and market conditions impacting demand for Velodyne Lidar’s products and services; and changes in applicable laws or regulations.

Given these factors, as well as other variables that may affect Velodyne Lidar’s operating results, you should not rely on forward-looking statements, assume that past financial performance will be a reliable indicator of future performance, or use historical trends to anticipate results or trends in future periods. The forward-looking statements included in this press release relate only to events as of the date hereof. Velodyne Lidar undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

In addition to our results determined in accordance with generally accepted accounting principles in the United States (GAAP), we believe the non‑GAAP measures of non-GAAP gross profit (loss), non-GAAP gross margin, non-GAAP operating expenses, non‑GAAP operating loss, non-GAAP other income (expenses), non-GAAP provision for (benefit from) income taxes, non-GAAP net loss, and non‑GAAP net loss per share are useful in evaluating our operating performance. Certain of these non-GAAP measures exclude stock-based compensation and related employer payroll taxes, litigation settlements, gain from sale of held-for-sale assets, write-off of deferred IPO costs, gain from forgiveness of PPP loan, amortization of acquisition-related intangibles assets, restructuring, and discrete tax items. We believe that non‑GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance and assists in comparisons with other companies, some of which use similar non‑GAAP information to supplement their GAAP results. The non‑GAAP financial information is presented for supplemental informational purposes only, and should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly‑titled non‑GAAP measures used by other companies. Reconciliation tables of the most comparable GAAP financial measures to the non-GAAP financial measures are used in this press release.

Andrew Chan

Head of Investor Relations

Codeword

Liv Allen

(In thousands)

(Unaudited)

| December 31, | |||

| 2021 | 2020 | ||

| Assets | |||

| Current assets: | |||

| Cash and cash equivalents | $ 24,064 | $ 204,648 | |

| Short-term investments | 270,357 | 145,636 | |

| Accounts receivable, net | 8,881 | 13,979 | |

| Inventories, net | 9,299 | 18,132 | |

| Prepaid and other current assets | 14,822 | 22,319 | |

| Total current assets | 327,423 | 404,714 | |

| Property, plant and equipment, net | 14,710 | 16,805 | |

| Goodwill | 1,189 | 1,189 | |

| Intangible assets, net | 724 | 627 | |

| Contract assets | 12,962 | 8,440 | |

| Other assets | 18,413 | 937 | |

| Total assets | $ 375,421 | $ 432,712 | |

| Liabilities and Stockholders’ Equity | |||

| Current liabilities: | |||

| Accounts payable | $ 5,105 | $ 7,721 | |

| Accrued expense and other current liabilities | 35,651 | 50,349 | |

| Contract liabilities | 6,348 | 7,323 | |

| Total current liabilities | 47,104 | 65,393 | |

| Long-term tax liabilities | 443 | 569 | |

| Other long-term liabilities | 28,611 | 25,927 | |

| Total liabilities | 76,158 | 91,889 | |

| Commitments and contingencies | |||

| Stockholders’ equity: | |||

| Preferred stock | — | — | |

| Common stock | 20 | 18 | |

| Additional paid-in capital | 825,988 | 656,717 | |

| Accumulated other comprehensive loss | (412) | (230) | |

| Accumulated deficit | (526,333) | (315,682) | |

| Total stockholders’ equity | 299,263 | 340,823 | |

| Total liabilities and stockholders’ equity | $ 375,421 | $ 432,712 |

(In thousands, except share and per share data)

(Unaudited)

| Three Months Ended | Year Ended | ||||||||

| December 31, 2021 | September 30, 2021 | December 31, 2020 | December 31, 2021 | December 31, 2020 | |||||

| Revenue: | |||||||||

| Product | $ 13,657 | $ 11,782 | $ 14,407 | $ 48,002 | $ 68,355 | ||||

| License and services | 3,885 | 1,278 | 3,439 | 13,922 | 27,007 | ||||

| Total revenue | 17,542 | 13,060 | 17,846 | 61,924 | 95,362 | ||||

| Cost of revenue: | |||||||||

| Product | 14,758 | 17,716 | 23,088 | 67,313 | 69,115 | ||||

| License and services | 92 | 84 | 99 | 525 | 1,131 | ||||

| Total cost of revenue | 14,850 | 17,800 | 23,187 | 67,838 | 70,246 | ||||

| Gross profit (loss) | 2,692 | (4,740) | (5,341) | (5,914) | 25,116 | ||||

| Operating expenses: | |||||||||

| Research and development | 22,255 | 20,221 | 48,427 | 77,863 | 88,080 | ||||

| Sales and marketing | 7,227 | 6,547 | 18,955 | 68,025 | 31,753 | ||||

| General and administrative | 10,867 | 23,271 | 38,790 | 70,307 | 65,732 | ||||

| Gain on sale of assets held-for-sale | — | — | — | — | (7,529) | ||||

| Restructuring | — | — | (59) | — | 984 | ||||

| Total operating expenses | 40,349 | 50,039 | 106,113 | 216,195 | 179,020 | ||||

| Operating loss | (37,657) | (54,779) | (111,454) | (222,109) | (153,904) | ||||

| Interest income | 127 | 109 | 33 | 448 | 152 | ||||

| Interest expense | 3 | (6) | (37) | (80) | (106) | ||||

| Other income (expense), net | 53 | (22) | 15 | 10,150 | (90) | ||||

| Loss before income taxes | (37,474) | (54,698) | (111,443) | (211,591) | (153,948) | ||||

| Provision for (benefit from) income taxes | (4) | 14 | 14 | 645 | (4,084) | ||||

| Net loss | $ (37,470) | $ (54,712) | $ (111,457) | $ (212,236) | $ (149,864) | ||||

| Net loss per share: | |||||||||

| Basic and diluted | $ (0.19) | $ (0.28) | $ (0.64) | $ (1.09) | $ (1.01) | ||||

| Weighted-average shares used in computing net loss per share: | |||||||||

| Basic and diluted | 197,385,362 | 196,204,671 | 173,888,792 | 193,982,168 | 148,088,589 |

(In thousands) (Unaudited)

| Three Months Ended | Year Ended | ||||||

| December 31, 2021 | December 31, 2020 | December 31, 2021 | December 31, 2020 | ||||

| Cash flows from operating activities: | |||||||

| Net loss | $ (37,470) | $ (111,457) | $ (212,236) | $ (149,864) | |||

| Adjustments to reconcile net loss to cash used in operating activities: | |||||||

| Depreciation and amortization | 2,244 | 2,053 | 8,452 | 8,394 | |||

| Reduction of operating lease right-of-use (“ROU”) assets | 764 | — | 3,052 | — | |||

| Write-off of deferred IPO costs | — | — | — | 3,548 | |||

| Stock-based compensation | 5,718 | 91,259 | 87,088 | 91,500 | |||

| Gain on sale of assets held-for-sale | — | — | — | (7,529) | |||

| Provision for doubtful accounts | 261 | (14) | 2,331 | 511 | |||

| Deferred income taxes | 3 | 4 | 3 | 4 | |||

| Gain from forgiveness of PPP loan | — | — | (10,124) | — | |||

| Accretion on short-term investments | 613 | — | 1,688 | — | |||

| Other | 49 | 63 | 22 | 137 | |||

| Changes in operating assets and liabilities: | |||||||

| Accounts receivable | 434 | 5,440 | 2,506 | (2,627) | |||

| Inventories, net | 2,560 | (1,710) | 8,833 | 1,619 | |||

| Prepaid and other current assets | (3,960) | (2,339) | (1,078) | 172 | |||

| Contract assets | (2,813) | (2,814) | (5,022) | (11,253) | |||

| Other assets | 99 | (305) | 166 | 53 | |||

| Accounts payable | 523 | (2,501) | (2,829) | 687 | |||

| Accrued expenses and other liabilities | 1,769 | 3,132 | (554) | (6,680) | |||

| Contract liabilities | (1,228) | 379 | (2,968) | 2,891 | |||

| Net cash used in operating activities | (30,434) | (18,810) | (120,670) | (68,437) | |||

| Cash flows from investing activities: | |||||||

| Purchase of property, plant and equipment and intangibles | (2,428) | (1,080) | (5,641) | (3,277) | |||

| Proceeds from sale of assets held-for-sale | — | — | — | 12,275 | |||

| Proceeds from sales of short-term investments | 14,215 | — | 26,422 | — | |||

| Proceeds from maturities of short-term investments | 73,000 | — | 188,223 | 2,200 | |||

| Purchase of short-term investments | (90,994) | (145,725) | (340,951) | (145,725) | |||

| Investment in notes receivable | — | — | (750) | — | |||

| Net cash used in investing activities | (6,207) | (146,805) | (132,697) | (134,527) | |||

| Cash flows from financing activities: | |||||||

| Proceeds from issuance of preferred stock, net of issuance costs | — | — | — | 19,919 | |||

| Proceeds from (payments for) Business Combination, net of transaction costs | — | (1,264) | (20,005) | 247,039 | |||

| Repurchase of common stock | — | — | — | (1,802) | |||

| Proceeds from warrant exercises, net of issuance costs of $52 | — | 73,713 | 89,270 | 73,713 | |||

| Proceeds from common stock issuance under equity incentive plans | 3,560 | — | 3,560 | — | |||

| Tax withholding payment for vested equity awards | — | — | (37) | — | |||

| Cash paid for IPO costs | — | — | — | (1,143) | |||

| Proceeds from notes payable | — | — | — | 10,000 | |||

| Net cash provided by financing activities | 3,560 | 72,449 | 72,788 | 347,726 | |||

| Effect of exchange rate fluctuations on cash and cash equivalents | 1 | (39) | (5) | (118) | |||

| Net increase (decrease) in cash and cash equivalents | (33,080) | (93,205) | (180,584) | 144,644 | |||

| Beginning cash and cash equivalents | 57,144 | 297,853 | 204,648 | 60,004 | |||

| Ending cash and cash equivalents | $ 24,064 | $ 204,648 | $ 24,064 | $ 204,648 |

(In thousands, except share and per share data) (Unaudited)

| Three Months Ended | Year Ended | ||||||||

| Dec. 31, 2021 | Sept. 30, 2021 | Dec. 31, 2020 | Dec. 31, 2021 | Dec. 31, 2020 | |||||

| Gross profit (loss) on GAAP basis | $ 2,692 | $ (4,740) | $ (5,341) | $ (5,914) | $ 25,116 | ||||

| Gross margin on GAAP basis | 15 % | (36) % | (30) % | (10) % | 26 % | ||||

| Stock-based compensation and related employer payroll taxes | 545 | 545 | 7,415 | 2,352 | 7,417 | ||||

| Gross profit (loss) on non-GAAP basis | $ 3,237 | $ (4,195) | $ 2,074 | $ (3,562) | $ 32,533 | ||||

| Gross margin on non-GAAP basis | 18 % | (32) % | 12 % | (6) % | 34 % | ||||

| Operating expenses on GAAP basis | $ 40,349 | $ 50,039 | $ 106,113 | $ 216,195 | $ 179,020 | ||||

| Stock-based compensation and related employer payroll taxes | (5,267) | (16,262) | (83,844) | (88,499) | (84,083) | ||||

| Legal settlements | 250 | (275) | (105) | (1,270) | (2,584) | ||||

| Gain from sale of held-for-sale assets | — | — | — | — | 7,529 | ||||

| Write-off of deferred IPO costs | — | — | — | — | (3,548) | ||||

| Amortization of acquisition-related intangible assets | (110) | (96) | (97) | (399) | (385) | ||||

| Restructuring charges | — | — | 59 | — | (984) | ||||

| Operating expenses on non-GAAP basis | $ 35,222 | $ 33,406 | $ 22,126 | $ 126,027 | $ 94,965 | ||||

| Operating loss on GAAP basis | $ (37,657) | $ (54,779) | $ (111,454) | $ (222,109) | $ (153,904) | ||||

| Stock-based compensation and related employer payroll taxes | 5,812 | 16,807 | 91,259 | 90,851 | 91,500 | ||||

| Legal settlements | (250) | 275 | 105 | 1,270 | 2,584 | ||||

| Gain from sale of held-for-sale assets | — | — | — | — | (7,529) | ||||

| Write-off of deferred IPO costs | — | — | — | — | 3,548 | ||||

| Amortization of acquisition-related intangible assets | 110 | 96 | 97 | 399 | 385 | ||||

| Restructuring charges | — | — | (59) | — | 984 | ||||

| Operating loss on non-GAAP basis | $ (31,985) | $ (37,601) | $ (20,052) | $ (129,589) | $ (62,432) | ||||

| Other income (expense), net | $ 53 | $ (22) | $ 15 | $ 10,150 | $ (90) | ||||

| Gain from forgiveness of PPP loan | — | — | — | (10,124) | — | ||||

| Other income (expense), net on non-GAAP basis | $ 53 | $ (22) | $ 15 | $ 26 | $ (90) | ||||

| Provision for (benefit from) income taxes on GAAP basis | $ (4) | $ 14 | $ 14 | $ 645 | $ (4,084) | ||||

| Non-GAAP tax reconciling adjustments | — | — | — | — | 6,679 | ||||

| Provision for (benefit from) income taxes on non-GAAP basis | $ (4) | $ 14 | $ 14 | $ 645 | $ 2,595 | ||||

| Net loss on GAAP basis | $ (37,470) | $ (54,712) | $ (111,457) | $ (212,236) | $ (149,864) | ||||

| Stock-based compensation and related employer payroll taxes | 5,812 | 16,807 | 91,259 | 90,851 | 91,500 | ||||

| Legal settlements | (250) | 275 | 105 | 1,270 | 2,584 | ||||

| Gain from sale of held-for-sale assets | — | — | — | — | (7,529) | ||||

| Write-off of deferred IPO costs | — | — | — | — | 3,548 | ||||

| Amortization of acquisition-related intangible assets | 110 | 96 | 97 | 399 | 385 | ||||

| Restructuring charges | — | — | (59) | — | 984 | ||||

| Gain from forgiveness of PPP loan | — | — | — | (10,124) | — | ||||

| Non-GAAP tax reconciling adjustments | — | — | — | — | (6,679) | ||||

| Net loss on non-GAAP basis | $ (31,798) | $ (37,534) | $ (20,055) | $ (129,840) | $ (65,071) | ||||

| Net loss per share on GAAP basis | |||||||||

| Basic and diluted | $ (0.19) | $ (0.28) | $ (0.64) | $ (1.09) | $ (1.01) | ||||

| Weighted-average shares on GAAP basis | |||||||||

| Basic and diluted | 197,385,362 | 196,204,671 | 173,888,792 | 193,982,168 | 148,088,589 | ||||

| Net loss per share on non-GAAP basis | |||||||||

| Basic and diluted | $ (0.16) | $ (0.19) | $ (0.12) | $ (0.67) | $ (0.44) | ||||

| Weighted-average shares on non-GAAP basis | |||||||||

| Basic and diluted | 197,385,362 | 196,204,671 | 173,888,792 | 193,982,168 | 148,088,589 |

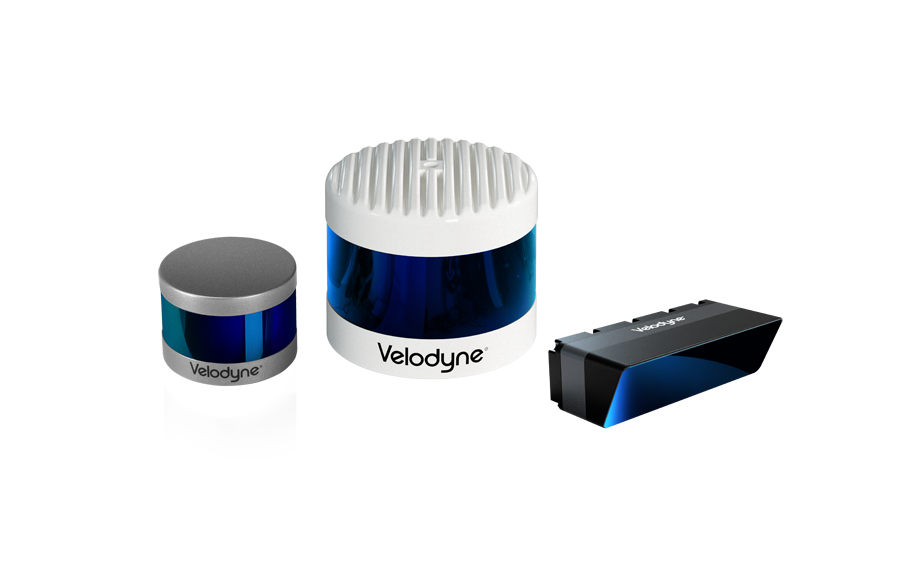

Velodyne Lidar (Nasdaq: VLDR, VLDRW) ushered in a new era of autonomous technology with the invention of real-time surround view lidar sensors. Velodyne, a global leader in lidar, is known for its broad portfolio of breakthrough lidar technologies. Velodyne’s revolutionary sensor and software solutions provide flexibility, quality and performance to meet the needs of a wide range of industries, including robotics, industrial, intelligent infrastructure, autonomous vehicles and advanced driver assistance systems (ADAS). Through continuous innovation, Velodyne strives to transform lives and communities by advancing safer mobility for all.